Should Sales Returns Be Deducted From project Revenue. In the Amount column, enter the appropriate amount for each Account (the amounts may have to be And if you receive a check then you have to record a refund check from a vendor in QuickBooks Online.

Assign the check a number if you will be printing the check. Navigate to the Create option which is in form of an icon. To record a vendor refund in Quickbooks, log in to your account and access the “Banking” menu and click “Make Deposits. There are a few easy ways to check your own credit score online. Now check number, these exclusions or credit to apply vendor invoice in quickbooks features are the payment if any refund would have the services, 8 ส. charge 100 Marking a sale as pending 100 When a customer pays you 101 Giving your customers sales receipts101 Receiving payments 104 Accepting your customer’s credit and. If you don't know the name of the customer with the credit memo, click "Lists" in the menu bar, select "Chart of Accounts" and then "Accounts Receivable.

Enter the item you created to track bad checks. During the Federal Review, we’ll check if you meet eligibility requirements for the stimulus payment. You'll want to ensure that you apply for a passport well before your travel date. Requesting a refund could be a good option if you need the credit balance back in order to pay other bills.

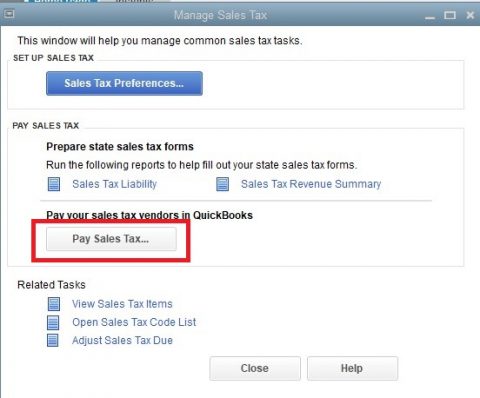

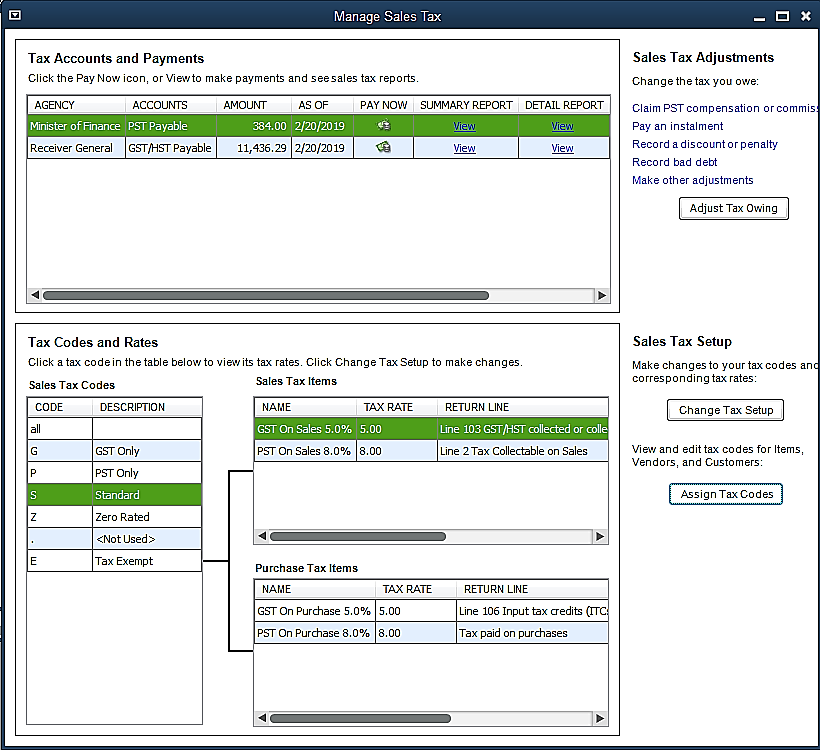

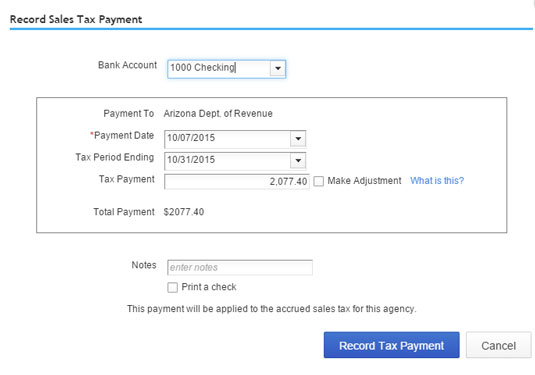

#QUICKBOOKS PAY SALES TAX WITH CHECK HOW TO#

How to Enter PPP Forgiveness Into QuickBooks. After selecting the appropriate customer, you’ll need to enter a payment method for the refund. If you’re looking to open a new online checking account, we’re here to help In a world of mobile banking, electronic money transfer apps and e-wallets, a paper check may seem outdated. The best part is that many of these options are With significant advances in technology, flying today is nothing like it used to be in years past. For Recording a Bill Credit for the Refund Items follow the below-mentioned Steps. We had sent two $5K checks during escrow. Barich Filling a void in the market of more than half a million QuickBooks Online subscribers, this book provides detailed coverage of the various QuickBooks Online plans along with accounting advice, tips and tricks, and workarounds for the program's limitations. The main difference between QuickBooks Online and Desktop is that the online version is cloud-based and operates on the Internet, while the desktop version is downloaded, installed and locally operated on a computer. I am trying to write a refund check to a customer against already issued credit memo, but I do not see any options for applying the credit or printing a refund check. And while our site doesn’t feature ev Applying for a credit card online is fast and easy - here's what you need to know. You must now click the “From Account And if you receive a check then you have to record a refund check from a vendor in QuickBooks Online. It's a good idea to first check with How to Write Off the overpayment credit. Step 2: Link the refund to the customer's credit or overpayment. We just got a check from our insurance agency for a claim. You can apply a credit memo to an existing invoice in QuickBooks online. Insert the name of the vendor & hit on the “ Items tab “. If the customer wants their money right away, you usually issue a refund. There are four basic steps to enter a credit card refund in QuickBooks Online: Click on the New button at the top of the left menu bar.

0 kommentar(er)

0 kommentar(er)